# BankConnect: Basics

One must be familiar with following terms before starting with BankConnect Integration Process:

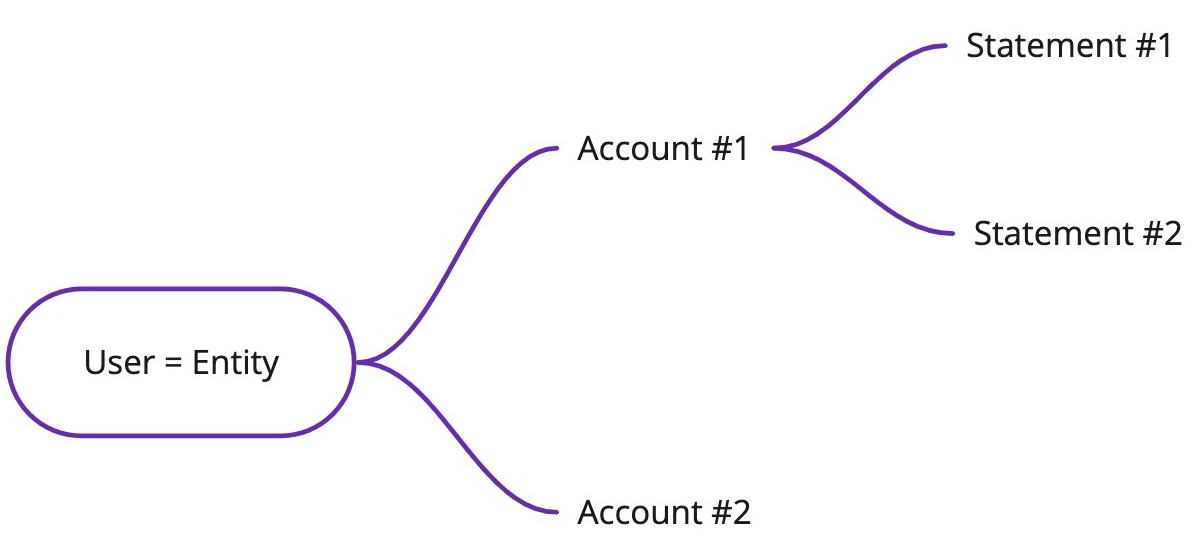

# Entity

A User is referred to as an Entity in BankConnect. It could be an individual or a company. FinBox refers to an entity with a unique identifier called entity_id.

# Account

Every entity can have multiple bank accounts in the same or different banks. These bank accounts are referred to as simply Accounts in BankConnect. FinBox refers to each account of an entity using a unique identifier, account_id.

# Statement

Now, every account can have multiple bank statements. These statements can belong to different time periods and can submitted directly or using net banking mode, over a period for a given entity. Each statement is referred using a unique identifier called statement_id.

When multiple statements are uploaded against an entity, BankConnect automatically recognizes the bank account and assigns the account_id to the statement.

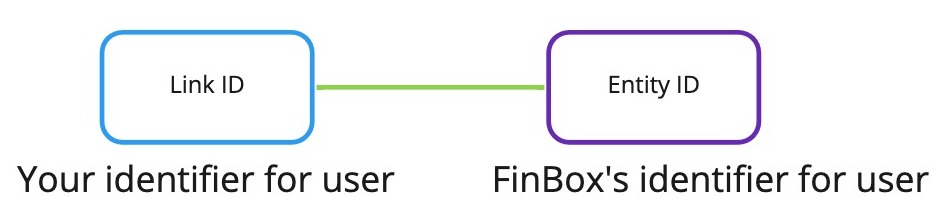

# Link ID

It is often required to refer to an entity by a unique identifier provided by you, this is what is called as a Link ID (link_id). There is a one-to-one mapping between link_id and entity_id.

Now since these terms are clear, you can head towards the next section Uploading Bank Statements which is the first step of the integration process.